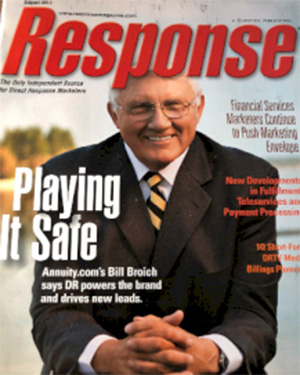

Bill Broich

, Founder

Annuity.com

Find Life Insurance With Affordable Premiums

Shop around and compare quotes from multiple insurers. Different insurers may have different rates for the same coverage, so it's important to compare quotes from multiple companies to find the best deal.

- Consider term life insurance. Term life insurance is generally less expensive than permanent life insurance, such as whole life or universal life. With term life insurance, you pay a premium for a specific period of time (the "term"), such as 10 or 20 years. If you pass away during the term, your beneficiaries will receive a death benefit. If you outlive the term, the policy will expire, and you will no longer be covered.

- Consider your coverage needs. The amount of coverage you need will affect the cost of your policy. Determine how much coverage you need based on your financial goals and the needs of your beneficiaries, and choose a policy that provides the right amount of coverage at a price you can afford.

- Consider your health. Insurers will consider your health when determining the premium for your policy. If you have good health, you may be able to qualify for lower premiums.

- Consider your lifestyle. Insurers may consider factors such as your occupation, hobbies, and whether you smoke when determining the premium for your policy. You may pay more for life insurance if you have a high-risk occupation or engage in risky hobbies. If you smoke, you may also pay more for life insurance.

- Considering working with an independent insurance agent. An independent insurance agent can help you compare quotes from multiple insurers and find a policy that fits your needs and budget.

- Many people looking for affordable life insurance choose the Do It Yourself. Numerous options exist for dealing directly with the insurance company instead of through an agent. While it can be complicated, there are numerous sources for at least exploring this option.

Bill Broich

Annuity.com

E. 171 Okonek

Grapeview, Washington 98546

bill.broich@retirevillage.com

(360) 701-6209

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!