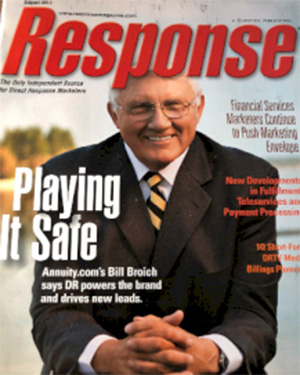

Bill Broich

, Founder

Annuity.com

Retirement Planning in the Age of Environmental Uncertainty

Environmental risks, especially those stemming from climate change and natural disasters, have become increasingly significant factors in retirement planning. The effects of these environmental shifts are far-reaching, impacting not just the physical world but also the financial stability and future security of individuals approaching retirement. This article will explore how climate change and natural disasters can influence retirement plans and what strategies can be implemented to mitigate these risks.

1. Impact on Retirement Locations

One of the primary considerations for retirees is deciding where to live. Climate change is altering the landscape of preferred retirement destinations. Areas once considered paradises for retirees, like coastal regions and warmer climates, now face increased risks of hurricanes, floods, and rising sea levels. Retirees must consider the long-term sustainability of their chosen location, factoring in potential increases in insurance costs, property taxes, and the possibility of environmental degradation.

2. Economic Implications

The economic implications of climate change and natural disasters on retirement planning are significant. Firstly, the increasing frequency and severity of natural disasters can lead to substantial financial losses due to property damage. Insurance premiums in high-risk areas are escalating, making living in or maintaining property in these regions more expensive.

Furthermore, climate change can indirectly impact the economy, affecting investment portfolios. Sectors like agriculture, real estate, and insurance are particularly vulnerable to climate-related events. This volatility can affect the performance of retirement investments and pensions, potentially reducing the income available to retirees.

3. Health-Related Costs

Environmental changes also pose health risks, particularly for the aging population. Increased temperatures and pollution can exacerbate health problems, leading to higher medical costs. Retirees must consider these potential expenses in their retirement planning, ensuring they have adequate health coverage and savings to address these issues.

4. Strategies for Mitigation

To mitigate the risks posed by environmental changes, retirees and those planning for retirement should consider the following strategies:

- Diversify Investments: Diversifying investment portfolios to include sectors less impacted by climate change can provide a buffer against economic fluctuations caused by environmental factors.

- Consider Sustainable Locations: When choosing a retirement location, prioritize areas with lower environmental risk profiles and sustainable infrastructure.

- Plan for Increased Costs: Factor in the potential for increased costs related to insurance, property maintenance, and healthcare due to environmental changes.

- Stay Informed: Keep abreast of environmental trends and policy changes that could impact retirement planning.

- Invest in Sustainable Funds: Consider allocating a portion of investments to environmentally sustainable funds, which may offer better long-term prospects in a world increasingly focused on mitigating climate change.

In the face of growing environmental risks, it's more important than ever to ensure your retirement plan is resilient and adaptable. Don't navigate these complex and evolving challenges alone. Reach out to a trusted financial advisor who can provide personalized guidance and strategies tailored to your unique situation. They can help you reassess your investment portfolio, evaluate insurance needs, and plan for a financially secure and environmentally conscious retirement. Contact your financial advisor today to take the first step towards a safer, more sustainable future.

- Climate Change Impact on Investments: Climate change affects sectors like agriculture, real estate, and energy, potentially decreasing the value of retirement investments in these areas.

- Pension Funds Vulnerability: Pension funds with investments in climate-affected industries may see reduced returns, impacting pension payouts.

- Insurance Premiums and Coverage: Natural disasters can lead to higher insurance premiums and changes in coverage, affecting retirees' costs and protection.

- Retirement Location Risks: Preferred retirement locations, often in areas prone to environmental risks, can face increased threats, endangering property and escalating living costs.

- Diversification and Sustainable Investing: Diversifying retirement portfolios and investing in environmentally sustainable options can help mitigate climate-related financial risks.

Many people have learned about the power of using the Safe Money approach to reduce volatility. Our Safe Money Guide is in its 20th edition and is available for free.

It is an Instant Download. Here is a link to download our guide:

Bill Broich

Annuity.com

E. 171 Okonek

Grapeview, Washington 98546

bill.broich@retirevillage.com

(360) 701-6209

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!