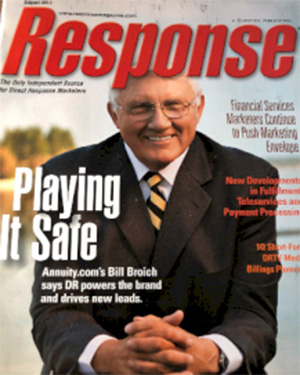

Bill Broich

, Founder

Annuity.com

The 6 Things You Should Know About Life Insurance But Probably Don't

Are you feeling overwhelmed by the different life insurance policies out there? Do you think you need more information to make an informed decision? Don't worry—you're not alone. Many people are unaware of life insurance's essential details, leaving them in the dark about some critical aspects of these products. We'll help shed some light on the topic and reveal five things about life insurance you may not already know.

- You're never too old to buy life insurance.

- You don't have to be wealthy to need life insurance.

- Life insurance can be used for more than just death benefits.

- There are different types of life insurance policies.

- Your life insurance policy will benefit more than just your family.

- Do-It-Yourself

Bill Broich

Annuity.com

E. 171 Okonek

Grapeview, Washington 98546

bill.broich@retirevillage.com

(360) 701-6209

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!