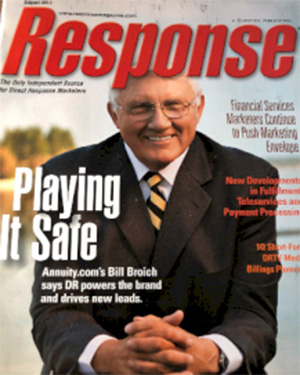

Bill Broich

, Founder

Annuity.com

Turn the Tables on Scammers with This Reporting Toolkit

Understanding the Scam or Fraud

1. Identifying the Scam:

Firstly, determine the nature of the scam or fraud. Is it an online phishing attempt, a telephone scam, a financial fraud, or identity theft? The type of scam often dictates to whom you should report it.

2. Common Types of Scams:

- Financial Scams: Involving banks, credit cards, loans, or investments.

- Internet Scams: Email fraud, online shopping scams, or fake websites.

- Telephone Scams: Unsolicited calls, robocalls, or fake charity solicitations.

- Identity Theft: Unauthorized use of personal information for financial gain.

Preparing to Report

1. Gathering Evidence:

Before you report the scam, collect as much evidence as you can. This includes:

- Documentation of Communications: Save all emails, texts, and call logs. Note dates, times, and details of conversations.

- Financial Records: If any transactions were made, keep detailed records, including bank statements, receipts, and credit card statements.

2. Recording Your Experience:

Write a detailed account of your experience. Include how you encountered the scam, the promises or threats, and any shared personal information.

Reporting the Scam

1. Local Law Enforcement:

Start with your local police department, especially if the scam involves significant money or identity theft. They can guide you on the necessary legal steps and may investigate the matter.

2. Federal Trade Commission (FTC):

For most scams in the U.S., the FTC is the primary agency for reporting. Use their online complaint assistant at ftc.gov/complaint. Your information can help them track scam patterns and take legal action against perpetrators.

3. Internet Crime Complaint Center (IC3):

For internet-related scams, report to the IC3 at ic3.gov. They handle complaints related to online fraud.

4. Consumer Financial Protection Bureau (CFPB):

For scams involving a financial product or service, file a complaint with the CFPB at consumerfinance.gov/complaint.

5. Contact Financial Institutions:

If your bank or credit card was involved, notify these institutions immediately. They can take steps to secure your accounts and investigate fraudulent transactions.

After Reporting

1. Informing Others:

Please share your experience with friends and family to protect them from similar scams. If appropriate, consider posting on social media to raise broader awareness.

2. Monitoring and Follow-Up:

Monitor your financial statements and credit reports for unusual activity. Stay in contact with the agencies you reported the scam to, and keep track of any case numbers or official information.

3. Stay Informed:

Keep abreast of common scams and fraud tactics. Government agencies and consumer protection websites often provide updates on current scam trends.

Reporting a scam or fraud might feel overwhelming, but it is a vital step in protecting yourself and others. By following these steps, you contribute to the more significant effort of combatting these illegal activities. Remember, your actions not only help in potentially catching the perpetrators but also in preventing future scams. Maintain a vigilant and proactive stance when dealing with scams and fraudulent activities.

Many people have learned about the power of using the Safe Money approach to reduce volatility. Our Safe Money Guide is in its 20th edition and is available for free.

It is an Instant Download. Here is a link to download our guide:

Bill Broich

Annuity.com

E. 171 Okonek

Grapeview, Washington 98546

bill.broich@retirevillage.com

(360) 701-6209

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!