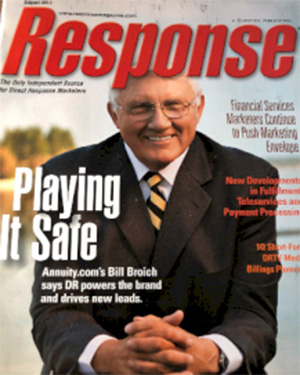

Bill Broich

, Founder

Annuity.com

Is Financial Planning Different Than Retirement Planning

Is Financial Planning Different Than Retirement Planning

What is the difference? Make sure you know.

Yes, it most certainly is. A financial plan will focus on the accumulation phase during your working years. Its purpose is to make sure you have a realistic target of how much money you will need after working. It also helps ensure that you’re saving and investing enough to hit the desired target when you retire. Financial planning is most helpful during your accumulation years.

By contrast, retirement income planning is designed to focus on replacing your paycheck once income stops and how various assets can generate an income stream that will cover your expenses for the rest of your life. Retirement income planning is much more detail-oriented, and it’s a different experience. It’s the difference between you at work and your money at work.

In my practice, I start by identifying sources of income. Work, Social Security, pensions, and other current income streams are available to meet the client’s needs. It’s essential to identify assets that can generate income, and estimate the sustainable income stream, to get a preliminary picture of each client’s situation.

It’s crucial to evaluate retirement risks and offer alternative solutions to address these risks. The top risks associated with retirement income planning are longevity risk, inflation risk, long-term care risk, health care risk, investment risk, reinvestment risk, public policy change risk, unexpected financial responsibilities, and early loss of a spouse.

Choosing the optimal Social Security, claiming age-appropriate for the client’s situation, is imperative. Many people start thinking about their claiming strategy once they reach their mid-fifties, most certainly by age 60.

Retirees surrounded by family and friends and who also have a check coming in every month for the rest of their lives are much happier, more stress-free, and live longer, more interesting lives, according to a study published in The Wall Street Journal.

Research shows that annuities can provide psychological, mental, and financial benefits. Many retirees using guaranteed income from annuities are more confident about affording their preferred retirement lifestyles even if they live to age 90 or older than those who do not own an annuity. The LIMRA Secure Retirement Institute published a recent report on February 20, 2018.

Annuities are powerful, but they’re not for everyone. Conducting a detailed retirement financial plan can be precious for anyone concerned or worried about who can afford to retire.

I see it all the time in my practice of retirement income planning. Our clients tell us that having a retirement plan makes retirement a lot more fun, with a lot less stress.

LIMRA Secure Retirement Institute: https://www.limra.com/secureretirementinstitute/research/

Bill Broich

Annuity.com

E. 171 Okonek

Grapeview, Washington 98546

bill.broich@retirevillage.com

(360) 701-6209

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!